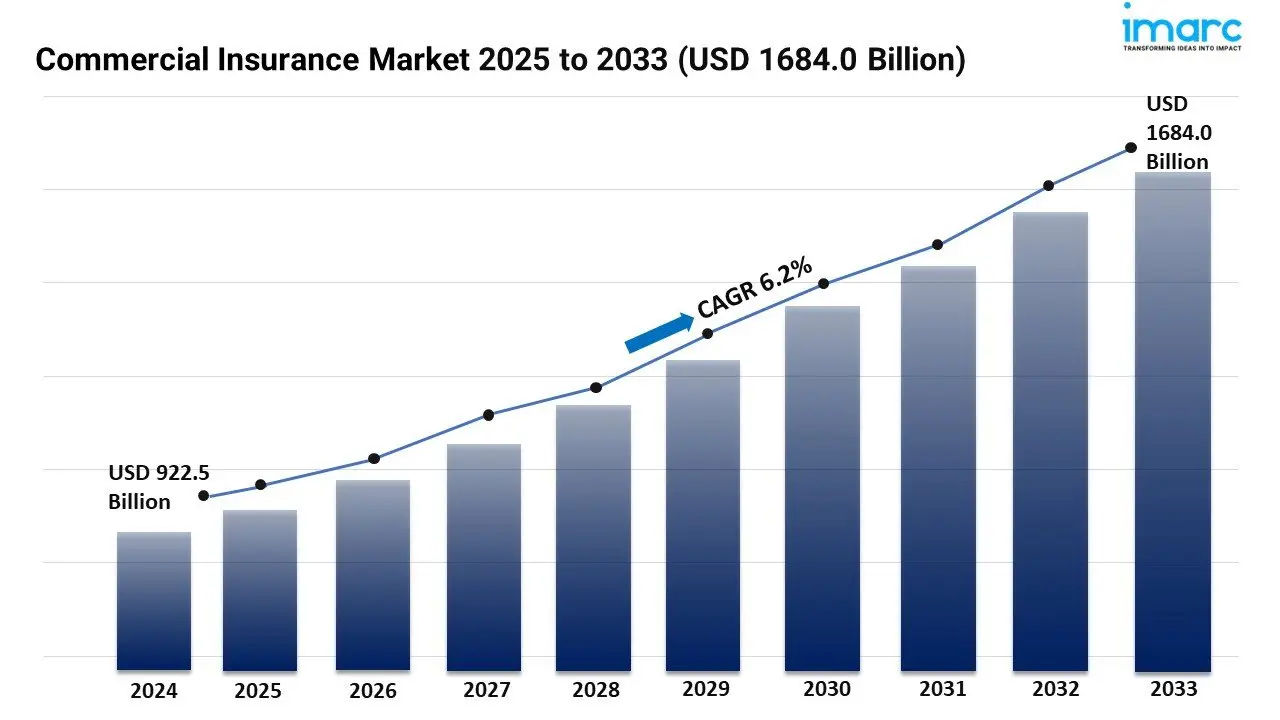

Global Commercial Insurance Market Statistics: USD 1,684.0 Billion Value by 2033

Summary:

- The global commercial insurance industry size reached USD 922.5 Billion in 2024.

- The market is expected to reach USD 1,684.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033.

- North America leads the market, accounting for the largest commercial insurance market share.

- Liability insurance holds the majority of the market share in the type segment as it is essential for protecting companies from costly lawsuits and compensation demands.

- Large enterprises exhibit a clear dominance in the commercial insurance industry.

- Agents and brokers remain a dominant segment in the market, due to their expertise in understanding risk profiles and negotiating terms with insurers.

- Transportation and logistics represent the leading industry vertical segment.

- The rising occurrence of natural disasters is a primary driver of the commercial insurance market.

- Regulatory changes and increasing cybersecurity threats are reshaping the commercial insurance market.

Industry Trends and Drivers:

- Natural disasters and climate change:

Insurers are raising premiums for businesses in areas more prone to extreme weather due to climate change. This helps cover potential property damage, business interruptions, and liability claims. The increasing number and severity of natural disasters are raising risks for businesses. To manage these risks, insurers are now offering specialized products. These include flood insurance, coverage for business interruptions caused by severe weather, and protection against environmental liabilities. Such products are aimed at businesses wanting to safeguard against climate-related risks.

- Regulatory changes:

New laws on the environment, health, and safety are forcing businesses to get specific insurance. For instance, they might need extra coverage for environmental issues, cyber threats, or employee health due to these laws. This demand is leading to new, specialized insurance products. Moreover, stricter data protection laws, such as GDPR, are increasing the need for cyber liability insurance. Businesses seek this coverage to protect against data breaches and legal penalties.

- Rising demand for cyber insurance policies:

As companies go digital, they face more cyber threats. This makes cyber insurance crucial. It protects against system failures, data loss, and downtime. Cyberattacks can also harm a company's reputation. So, businesses seek insurance that covers public relations, legal fees, and customer notifications. This helps restore trust. With rules like GDPR and CCPA, companies need policies that meet data protection standards. The rise in cyber incidents boosts the demand for cyber insurance. This insurance helps mitigate financial and reputational risks.

Request for a sample copy of this report: https://www.imarcgroup.com/commercial-insurance-market/requestsample

Commercial Insurance Market Report Segmentation:

Breakup By Type:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Liability insurance represents the largest segment because businesses face various risks related to third-party injuries, damages, or legal claims, making liability coverage essential for protecting operations.

Breakup By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share as they typically require more extensive coverage for their complex operations, higher assets, and greater exposure to risks.

Breakup By Distribution Channel:

- Agents and Brokers

- Direct Response

- Others

Agents and brokers exhibit a clear dominance in the market owing to their personalized services, expert advice, and businesses navigation insurance products.

Breakup By Industry Vertical:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Transportation and logistics hold the biggest market share due to the significant risks associated with the movement of goods, including accidents, delays, and cargo loss.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the commercial insurance market on account of its established insurance infrastructure, rising demand from diverse industries, and a robust regulatory framework.

Top Commercial Insurance Market Leaders:

The commercial insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Allianz SE

- American International Group Inc.

- Aon plc

- Aviva plc

- Axa S.A.

- Chubb Limited

- Direct Line Insurance Group plc

- Marsh & McLennan Companies Inc.

- Willis Towers Watson Public Limited Company

- Zurich Insurance Group Ltd.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Leave a Comment