The BRICS Summit in Kazan sees 13 new nations join, marking a major shift toward a multipolar world and questioning the stability of U.S. global influence.

By yourNEWS Media Newsroom

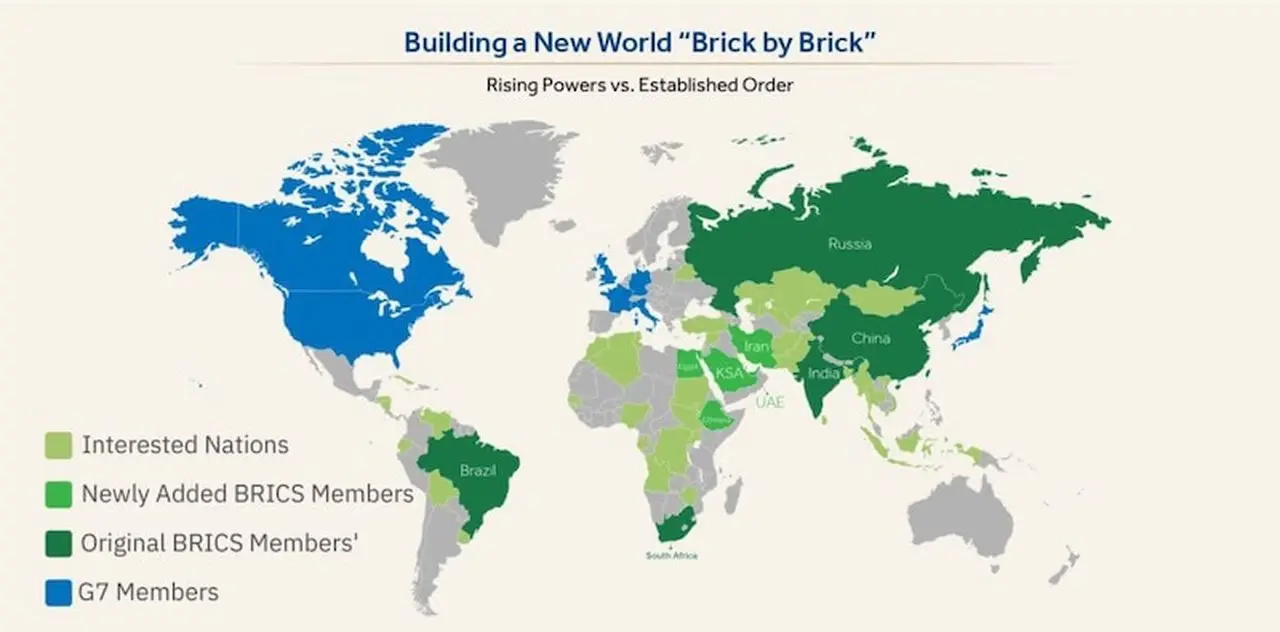

This week’s BRICS Summit in Kazan, Russia, signified a dramatic reconfiguration in global alliances as 13 nations joined the expanding coalition, with another 45 expressing interest, Michael West Media reported. The summit saw notable attendees like Brazil, Russia, India, China, and South Africa, as well as diplomatic strides made between former adversaries Armenia and Azerbaijan, all suggesting a world order moving increasingly away from U.S.-centered influence.

Image: What the Media Hides, X

While the summit represented a pivotal moment in global power shifts, it received limited attention in Western media. According to Globalstats, 36 countries sat at the BRICS table, discussing economic cooperation and policies aimed at reducing reliance on the U.S. dollar in global trade. Countries across continents are gravitating toward BRICS amid frustrations with Western-led sanctions, high inflation, and perceived dominance of the U.S. and its allies.

A key agenda item was the possible introduction of a BRICS settlement system in which member countries could trade using their own currencies, thus avoiding reliance on the U.S. dollar. The potential shift is significant: BRICS represents 35% of global GDP, with the G7 countries accounting for 30%. With BRICS countries holding 45% of the world’s population, a trend toward de-dollarization would have profound effects on global finance and U.S. economic leverage.

BREAKING🚨 159 out of 193 countries have signed up to use the new BRICS settlement system.

US and European Union will no longer be able to use economic sanctions as a weapon.

This system allows countries to settle trades and payments in their own currencies, reducing reliance… pic.twitter.com/5W8cvHNKhI

— Pelham (@Resist_05) October 25, 2024

Diplomatic and Economic Alignments

The summit also underscored the movement of key players, such as South Africa’s Cyril Ramaphosa and India’s Narendra Modi, away from traditional alliances, choosing the BRICS meeting over the Commonwealth Heads of Government Meeting (CHOGM) in Samoa. This year, India’s economy surpassed the UK’s, adding to a series of symbolic shifts in global power that once favored the Western powers. Meanwhile, Sri Lanka, which is applying to join BRICS, also opted to forgo sending high-level officials to CHOGM.

List of 41 countries which have officially applied for #BRICS membership and have expressed interest in joining.

Turkey and Venezuela would be great additions for strategic reasons.#BRICS2024 pic.twitter.com/ol6rFkST2B

— S.L. Kanthan (@Kanthan2030) October 23, 2024

At the summit, BRICS leaders discussed areas of common interest, including energy security and resource extraction—issues of critical importance in today’s volatile economy. A statement from Vladimir Putin, supporting Venezuela’s President Nicolás Maduro and calling for peaceful dialogue, further highlighted the coalition’s divergence from U.S.-aligned narratives. As Russia’s war in Ukraine remains an international flashpoint, Putin’s attempt to garner support met resistance from Chinese President Xi Jinping, who prioritized BRICS’ broader aims over Russian-Ukrainian tensions, according to The Guardian.

Economic Ripples and Implications for the Dollar

A move by BRICS to facilitate transactions in local currencies could reduce U.S. economic dominance. This sentiment was echoed by The Globalist, which reports that 159 out of 193 UN countries have agreed to explore the BRICS financial model, which would allow trade settlements outside the traditional U.S.-dollar system. As inflation and interest rates climb, concerns grow that a drop in demand for U.S. dollars could hurt the American economy by increasing import costs and limiting foreign investment.

De-dollarization is happening everywhere – from Asia to Africa and Latin America.

The “exorbitant privilege” of dollar is coming to an end.

The American century is over. #BRICS #BRICS2024 pic.twitter.com/RGU82u6DRH

— S.L. Kanthan (@Kanthan2030) October 23, 2024

The U.S. government downplayed the significance of the BRICS summit, with White House Press Secretary Karine Jean-Pierre remarking, “We’re not looking at BRICS evolving into some kind of geopolitical rival … to the U.S. or anyone else.” Yet as the price of gold hits record highs and global demand for alternative currencies rises, analysts suggest the dollar’s role as the world’s reserve currency is under unprecedented threat.

Australia’s Position Amid the Shifts

In Australia, the alignment with U.S.-backed security initiatives, such as AUKUS, stands in stark contrast to the growing momentum behind BRICS. Observers argue that Australia risks becoming isolated from a rapidly evolving global order if it does not reconsider its foreign policy strategy. Australia’s deepening involvement with the U.S. and UK, especially through military pacts, could hinder its ability to form independent relations with emerging powers.

As BRICS expands to include influential economies like Egypt, Iran, Saudi Arabia, and the UAE, Australia faces tough questions about its long-term positioning. Critics note that while the country’s defense and foreign policy establishments remain entrenched in American-led alliances, regional allies are opting for new partnerships that emphasize economic independence and resource security over adherence to Western power structures.

The recent BRICS summit marks a defining moment in the geopolitical landscape, underscoring the increasing polarization between U.S.-centered alliances and the emerging multi-polarity of BRICS nations. With countries worldwide reevaluating their alliances, Australia may find itself compelled to reassess its strategic commitments to remain relevant in an increasingly complex world order.

WATCH:

SOURCE

Leave a Comment